Income-producing assets are investments that generate cash flow for you. Examples of income-producing assets include rental properties, dividend-paying stocks, bonds, and mutual funds. When you invest in an income-producing asset, you can expect to receive a regular stream of income from that investment.

One of the biggest advantages of income-producing assets is that they can provide a source of passive income. That means you can earn money without having to actively work for it. If you’re looking to build wealth over the long term, having a source of passive income can be a huge help.

Another advantage of income-producing assets is that they can provide a hedge against inflation. When prices rise over time, the value of your cash holdings will decrease. However, if you own income-producing assets, the income they generate may rise along with inflation.

Understanding Income-Generating Assets

Definition of income-generating assets

Income-generating assets refer to investments or holdings that consistently generate income over time. Unlike assets that rely solely on appreciation in value, such as stocks or real estate for resale, income-generating assets provide regular returns in the form of income.

These assets can include various types of investments, such as rental properties, dividend-paying stocks, bonds, and even businesses.

The primary purpose of income-producing assets is to generate a steady stream of revenue, which can contribute to financial stability, wealth accumulation, and long-term financial goals.

By earning consistent income, individuals can reduce their reliance on traditional employment income and achieve greater financial independence.

Overall, income-generating assets play a crucial role in building and preserving wealth over time, offering a reliable source of income regardless of market conditions.

Importance of building a portfolio of income-producing assets

Building a portfolio of income-producing assets holds significant importance in securing financial stability and long-term prosperity. These assets provide a steady stream of income that can supplement or even replace earned income, offering a source of financial security and peace of mind. By diversifying income streams through various assets, individuals can spread risk and mitigate the impact of economic downturns or unforeseen circumstances.

Moreover, income-producing assets facilitate wealth accumulation over time. The consistent income generated from these assets can be reinvested to further grow one’s portfolio or used to meet financial goals such as retirement, education expenses, or purchasing a home. This compounding effect allows individuals to build wealth steadily over time, regardless of fluctuations in the broader economy.

Additionally, income-producing assets offer a degree of passive income, allowing individuals to earn money with minimal effort or active involvement. This passive income stream provides financial flexibility and freedom, enabling individuals to pursue their passions, spend time with family, or explore new opportunities without worrying about financial constraints.

Furthermore, building a portfolio of income-producing assets promotes financial independence. By relying less on traditional employment income and diversifying income sources, individuals gain greater control over their financial destiny. They become less susceptible to job loss, wage stagnation, or other external factors that may impact earned income.

Overall, the importance of building a portfolio of income-producing assets cannot be overstated. These assets provide stability, security, and the potential for long-term wealth accumulation, offering individuals a pathway to financial freedom and peace of mind.

Benefits of Income-Generating Assets

Income-generating assets offer several key benefits that contribute to financial stability and long-term prosperity:

Passive Income Generation: One of the primary benefits of income-generating assets is the ability to generate passive income. Unlike earned income, which requires active participation in work-related activities, income from these assets is generated with minimal ongoing effort. This passive income stream provides individuals with financial flexibility and freedom, allowing them to cover expenses, pursue hobbies, or reinvest in further asset growth without relying solely on traditional employment.

Wealth Accumulation and Financial Security: Income-generating assets play a crucial role in wealth accumulation over time. The consistent income generated from these assets can be reinvested to further grow one’s portfolio or used to achieve financial goals such as retirement, education expenses, or purchasing a home. By steadily accumulating wealth through income-generating assets, individuals can build a financial safety net and enhance their long-term financial security.

Diversification of Income Streams: Another significant benefit of income-generating assets is the diversification of income streams. Relying solely on one source of income, such as a job, can leave individuals vulnerable to financial instability in the event of job loss, wage cuts, or economic downturns. Income-generating assets offer an opportunity to diversify income streams, spreading risk and reducing dependence on any single source of revenue. This diversification enhances financial resilience and provides a buffer against unexpected financial challenges.

Tips for beginners on purchasing income-generating assets

For beginners looking to purchase income-generating assets, here are some practical tips to consider:

Start with Education: Before diving into any investment, it’s crucial to educate yourself about the various types of income-generating assets available, their risks, and potential returns. Take the time to read books, attend seminars, or seek advice from experienced investors to build a solid foundation of knowledge.

Set Clear Goals: Define your investment objectives and financial goals before making any investment decisions. Are you looking for passive income to supplement your current earnings? Are you aiming to build long-term wealth? Understanding your goals will help you choose the most suitable income-generating assets for your needs.

Assess Risk Tolerance: Assess your risk tolerance level to determine the types of assets that align with your comfort level. Some income-generating assets, such as stocks, may offer higher returns but also come with higher risk, while others, like bonds, provide more stable but lower returns. Choose assets that match your risk tolerance and investment horizon.

Start Small: As a beginner, it’s wise to start small and gradually build your investment portfolio over time. Consider investing a small amount of money initially to gain experience and confidence in the investment process. You can always increase your investment as you become more comfortable and knowledgeable.

Diversify Your Portfolio: Diversification is key to reducing risk in your investment portfolio. Instead of putting all your money into one asset class or investment, consider diversifying across different types of income-generating assets, such as real estate, stocks, bonds, and alternative investments. This spreads risk and enhances the overall stability of your portfolio.

Conduct Due Diligence: Before making any investment, conduct thorough research and due diligence to assess the potential risks and returns. Research the asset class, evaluate the investment opportunity, and consider factors such as market trends, historical performance, and the reputation of the investment issuer or provider.

Seek Professional Advice: Consider seeking advice from financial advisors or investment professionals, especially if you’re unsure about where to start or how to proceed. A qualified advisor can provide personalized guidance based on your individual financial situation and goals, helping you make informed investment decisions.

Monitor and Review: Once you’ve made investments in income-generating assets, regularly monitor and review your portfolio’s performance. Stay informed about market developments, economic trends, and changes in asset values. Periodically reassess your investment strategy and make adjustments as needed to ensure your portfolio remains aligned with your financial goals.

Types of Income-Generating Assets

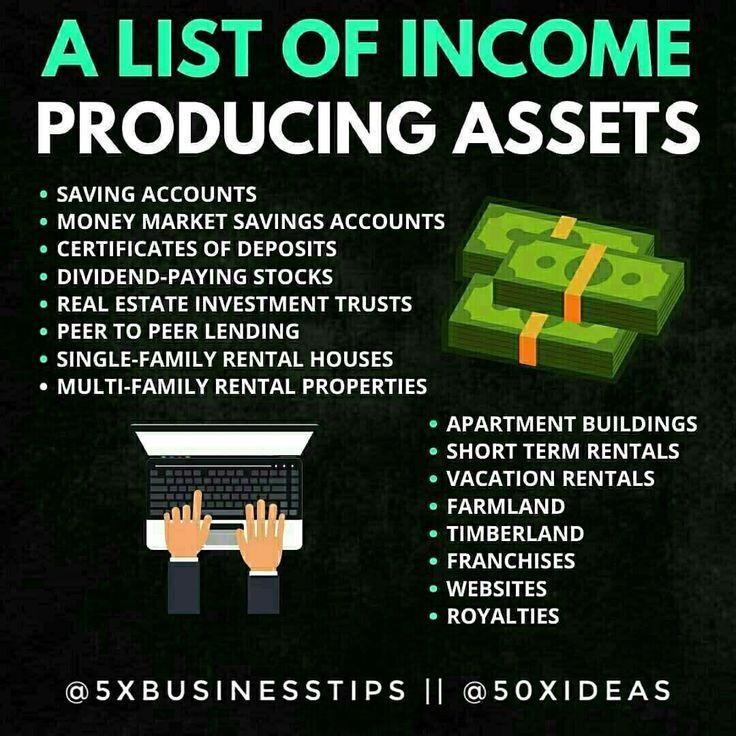

When it comes to income-generating assets, there are various types to consider, each offering unique opportunities for generating steady income. Here are some common types of income-generating assets:

Real Estate Investments

Buying Rental Properties: Purchasing rental properties is a popular option for generating passive rental income. By investing in residential or commercial properties, you can earn consistent cash flow from tenants’ rent payments.

Investing in Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate. Investing in REITs allows you to gain exposure to real estate assets without the need for direct ownership. REITs typically distribute a significant portion of their income to shareholders in the form of dividends.

Dividend-Paying Stocks

Selecting Dividend-Paying Stocks: Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. Investing in dividend-paying stocks can provide a steady stream of income, making them attractive for income-focused investors.

Building a Diversified Portfolio of Income-Producing Equities: Building a diversified portfolio of income-producing equities involves selecting a mix of dividend-paying stocks across different sectors and industries. This diversification helps spread risk and maximize potential returns.

Bonds and Fixed-Income Securities

Investing in Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you’re essentially lending money to the issuer in exchange for regular interest payments (coupon payments) and the return of the principal amount at maturity.

Exploring High-Yield Bonds: High-yield bonds, also known as junk bonds, offer higher interest rates than investment-grade bonds but come with higher risk. These bonds are issued by companies with lower credit ratings and may be more susceptible to default risk.

Business Ownership

Starting or Acquiring a Business: Owning a business can be a lucrative source of ongoing profits and income. Whether you start your own venture or acquire an existing business, entrepreneurship offers the opportunity to build equity and generate income from sales, services, or products.

Franchise Ownership: Franchise ownership is another option for generating passive income. By purchasing a franchise, you gain access to a proven business model, brand recognition, and ongoing support from the franchisor. Franchise owners typically earn income through royalty fees and franchisee fees.

These are just a few examples of income-generating assets that investors can consider when building a diversified investment portfolio. Each type of asset has its own risk-return profile, so it’s essential to conduct thorough research and consider your financial goals, risk tolerance, and investment horizon before making any investment decisions. By diversifying across different asset classes and investment vehicles, you can create a well-balanced portfolio that generates steady income and long-term growth potential.

Strategies for Low-Cost Income-Generating Assets

When seeking low-cost income-generating assets, there are several strategies to consider that can provide opportunities for generating income without requiring substantial upfront capital. Here are some effective strategies for acquiring low-cost income-generating assets:

Exploring Low-Cost Investment Options

Dividend Reinvestment Plans (DRIPs): DRIPs allow investors to reinvest dividends from stocks into additional shares of the same stock. This strategy enables investors to compound their returns over time without incurring additional costs or fees.

Micro-Investing Platforms: Micro-investing platforms offer a convenient and affordable way to invest small amounts of money in diversified portfolios of stocks, bonds, or ETFs. These platforms often have low minimum investment requirements and may offer fractional shares, allowing investors to start with minimal capital.

Investing in Low-Cost Index Funds or ETFs

Low-Cost Index Funds: Index funds are mutual funds that aim to replicate the performance of a specific market index, such as the S&P 500. These funds typically have lower management fees and expenses compared to actively managed funds, making them a cost-effective option for income generation.

Exchange-Traded Funds (ETFs): ETFs are similar to index funds but trade on stock exchanges like individual stocks. ETFs often have lower expense ratios than mutual funds and can provide exposure to a wide range of asset classes, sectors, and geographic regions.

Building Assets with No Money

Leveraging Skills and Expertise: Consider leveraging your skills, expertise, or talents to create digital products or offer services that can generate income. This could include writing e-books, designing websites, providing consulting services, or offering online courses. With minimal overhead costs, digital products and services can be a cost-effective way to generate income.

Partnering with Others: Collaborating with others through joint ventures or partnerships can provide opportunities to generate income without requiring significant capital investment. By pooling resources, skills, and networks, you can create synergistic partnerships that benefit all parties involved. Whether it’s co-authoring a book, launching a podcast, or organizing a workshop, partnerships can help amplify your income-generating potential.

By exploring these strategies for acquiring low-cost income-generating assets, you can create opportunities to generate income and build wealth without the need for substantial upfront capital. Whether you’re investing in low-cost investment options, leveraging your skills and expertise, or partnering with others, there are various avenues to pursue that can help you achieve your income goals and financial aspirations.

The Bottom Line

In summary, acquiring income-generating assets involves thorough research and diversification across various asset classes like real estate, stocks, bonds, and businesses. Utilizing low-cost options and leveraging skills or partnerships can help initiate investments without significant capital. Starting early and maintaining consistency are crucial for harnessing the power of compounding and building long-term financial security. By adhering to sound investment strategies and staying committed to your goals, you can create a portfolio of assets that generates steady income and fosters lasting wealth accumulation.

Frequently Asked Questions (FAQs)

What are income-generating assets?

Income-generating assets are investments that provide a regular stream of income, such as rental properties, dividend-paying stocks, bonds, and mutual funds. These assets allow you to earn money without actively working for it.

Why are income-generating assets important?

Income-generating assets offer passive income, act as a hedge against inflation, and contribute to long-term wealth accumulation. They provide financial stability, diversification of income streams, and the potential for financial independence.

What are some tips for beginners on purchasing income-generating assets?

Beginners should start with education, set clear investment goals, assess their risk tolerance, start small, diversify their portfolio, conduct due diligence, seek professional advice if needed, and regularly monitor and review their investments.

What are some common types of income-generating assets?

Common types of income-generating assets include real estate investments (rental properties, REITs), dividend-paying stocks, bonds and fixed-income securities, and business ownership (starting or acquiring a business, franchise ownership).

What are some strategies for acquiring low-cost income-generating assets?

Strategies for acquiring low-cost income-generating assets include exploring low-cost investment options (DRIPs, micro-investing platforms, index funds, ETFs), building assets with no money (leveraging skills and expertise, partnering with others), and utilizing cost-effective investment vehicles.